Q. Which Woodsville Guaranty Savings Bank branches are becoming Bar Harbor Bank & Trust branches?

A. The nine branches include the locations below:

- Woodsville: 63 Central Street

- Woodsville Walmart: 4901 Dartmouth College Hwy

- Lisbon: 28 South Main Street

- Littleton: 618 Meadow Street

- Littleton: 189 Cottage Street

- Lancaster: 199 Main Street

- Piermont: 37 Route 25

- Plymouth: 7 Town West Road

- Franconia: 278 Main Street

Q. When will changes occur?

A. Changes will occur during conversion weekend, which currently is scheduled for October 11-13, 2025. All former Woodsville Guaranty Savings Bank locations will be open on Friday, October 10. Branches will be closed October 11-13, including the federal holiday, and begin to offer Bar Harbor Bank & Trust products when they reopen at their normal time on Tuesday, October 14.

Q. How will the conversion affect the hours at my local branch?

A. The nine branches mentioned above will be open during scheduled hours on Friday, October 10. All branches will be closed Saturday and Sunday, October 11-12, and the federal holiday on Monday, October 13. All branches will reopen at their normal time on Tuesday, October 14.

Q. Will I still be able to bank at my current branch?

A. Yes, starting on October 14 you will be able to access your accounts at any Bar Harbor Bank & Trust branch.

Q. Will the branch staff be the same?

A. Yes, you can still expect to work with the same friendly bankers at all branches.

Q. Will branch hours change?

A. No, branch hours will not change.

Q. Where will I do my banking in the future?

A. After conversion, customers will have access to more than 60 Bar Harbor Bank & Trust branches across Maine, New Hampshire, and Vermont, as well as Bar Harbor Bank & Trust ATMs, Bar Harbor Mobile, Bar Harbor Online, telephone banking, and our Customer Service Center.

Q. Will my deposit account number change?

A. Most account numbers will not change with the conversion to Bar Harbor Bank & Trust products. You will be notified separately if your account number is changing.

Q. What will happen to my direct deposits? Do I need to provide new account or routing numbers to my payment providers (ex. employer, social security, etc.)?

A. Your existing routing number will continue to function after the conversion. Beginning October 14, you can use your existing routing number or Bar Harbor Bank & Trust’s routing number: 011201759.

Q. What is Bar Harbor Bank & Trust’s routing and transit (ABA) number?

A. Bar Harbor Bank & Trust’s routing number is 011201759. Please do not use this number until October 14.

Q. Where can I get information about Bar Harbor Bank & Trust’s products and services?

A. For additional information, you may visit www.barharbor.bank/welcome or stop by any existing Bar Harbor Bank & Trust branch.

Q. Will my checking and savings account type and/or features change?

A. Yes. After conversion your account will be converted into a Bar Harbor Bank & Trust checking or savings product with similar features and benefits. The letter you received in the Welcome Kit that was mailed to you in mid-September shows what product your account will be converted to with Bar Harbor Bank & Trust.

Q. Will there be changes to my deposit statement?

A. You can expect to receive multiple bank statements in October. The first will come from Woodsville Guaranty Savings Bank and will encompass all your activity through October 10, 2025. The second statement will come from Bar Harbor Bank & Trust and will include your activity from October 11, 2025 through the end of your statement cycle.

Q. I see another Bar Harbor Bank & Trust account that meets my needs better than the account that was selected for me. Can I change into that account?

A. Yes. You can easily change account types any time after October 14 by calling 800-564-2735 or visiting any Bar Harbor Bank & Trust branch.

Q. Will the date of my scheduled automatic transfers change?

A. Transfer dates will not change and there will not be any disruption in your automatic transfers during conversion weekend.

Q. Will my Overdraft Protection Service still apply to my checking account? Will my ATM and everyday debit card transactions be paid?

A. Yes. If you opted in to overdraft protection at Woodsville Guaranty Savings Bank you will continue to have that service at Bar Harbor Bank & Trust. Please see the Account Agreement for details and limits. If you opted in to have ATM and debit transactions paid at Woodsville Guaranty Savings Bank they will continue to be paid at Bar Harbor Bank & Trust.

Q. I have deposits at both Woodsville Guaranty Savings Bank and Bar Harbor Bank & Trust, how does FDIC deposit coverage work?

A. For the six months immediately following August 1, 2025, the FDIC will separately insure funds previously held at Woodsville Guaranty Savings Bank from accounts held at Bar Harbor Bank & Trust up to $250,000 per ownership category. Visit the FDIC’s Electronic Deposit Insurance Estimator for more detailed information (https://edie.fdic.gov/). Consult your local branch about deposit insurance options above $250,000 per account.

Q. If I write a check in October using a Woodsville Guaranty Savings Bank check, will it still clear once after my account converts to Bar Harbor Bank & Trust?

A. Yes. Woodsville Guaranty Savings Bank checks will continue to clear after your account converts to Bar Harbor Bank & Trust. Once you run out of your Woodsville Guaranty Savings Bank checks you should order Bar Harbor Bank & Trust checks and use those in the future. If your account number needs to change, we will contact you directly and provide you with new checks.

Q. What should I do with my Woodsville Guaranty Savings Bank checks once the account conversion is complete?

A. You can continue to use your remaining supply of Woodsville Guaranty Savings Bank checks after October 14, 2025. Information on how to order checks for your Bar Harbor Bank & Trust account can be found in the Checks section of this page. See the Account Agreement and Disclosures booklet for details specific to your Bar Harbor Bank & Trust account when it is time to order more checks.

Q. What happens if I run out of checks before October 14?

A. If you run out of checks prior to October 14, we can help you re-order Woodsville Guaranty Savings Bank checks. If you run out of checks after October 14, we can help you order Bar Harbor Bank & Trust check stock. Checks can also be ordered via our website or online and mobile banking.

Q. Can I pre-order Bar Harbor Bank & Trust checks?

A. There is no need to pre-order Bar Harbor Bank & Trust checks as you can continue to use your Woodsville Guaranty Savings Bank checks until they are depleted. If you wish to order Bar Harbor Bank & Trust checks, you can do so on or after October 14, 2025.

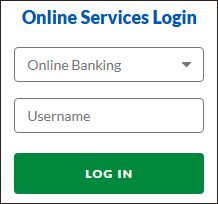

Q. Will I have to re-enroll to use online and mobile banking?

A. After conversion, you will need to log in to Bar Harbor Online to use online banking and download and log in to Bar Harbor Mobile to use mobile banking. Instructions can be found in the Online and Mobile Banking section of this page.

Q. Will my username and password for online banking change?

A. Most customers will be able to log in to Bar Harbor Online and Bar Harbor Mobile using their current username and password. If a change to your username or password is necessary, we’ll notify you directly.

Q. How will mobile deposit be impacted?

A. Mobile deposit will be unavailable from 5 p.m. on October 10 until October 14. At that time, qualified users can simply log in to Bar Harbor Mobile (see the Online and Mobile Banking section of this page for instructions), click deposit check, and follow the prompts to begin making new deposits.

Q. Will I receive a new debit card?

A. Yes. You will receive your new Bar Harbor Bank & Trust debit card via mail prior to conversion.

Q. Will I need to re-establish automatic payments from my debit card?

A. Yes. Once you receive and activate your new Bar Harbor Bank & Trust debit card you will need to re-establish all of your automatic payments using your new debit card number.

Q. Will any branches have instant issue debit cards?

A. Yes. All branches will have instant issue capabilities after conversion.

Q. Will I still be able to access historical statements, notifications, etc. from Woodsville Guaranty Savings Bank in Bar Harbor Online?

A. There will not be any disruption of your historical account data. But as a best practice we recommend that you download and store any historic data related to your Woodsville Guaranty Savings Bank accounts before October 10 that you may want to access in the future.

Q. Will my CD rate remain the same?

A. Existing CD rates will be honored through maturity.

Q. Will the rate change on my loan?

A. No, your current loan rate and terms will remain the same.

Q. I currently have a mortgage. Will I see any immediate changes?

A. Your term, rate, and payment amount and due dates will remain the same. After October 14 you will start receiving your monthly statement from Bar Harbor Bank & Trust.

Q. I currently have a home equity loan. Will I see any immediate changes?

A. Your term, rate, and payment amount and due dates will remain the same. After October 14 you will start receiving your monthly statement from Bar Harbor Bank & Trust.

Q. Where can I make a payment on my loan?

A. Beginning on October 14 you can make a payment at any Bar Harbor Bank & Trust branch or you can mail your payment(s) to:

Bar Harbor Bank & Trust

Attn: Loan Servicing

PO Box 1089

Ellsworth, ME 04605

Contact our Customer Service Center for information on automatic payments.

![]() Bar Harbor Bank & Trust debit cards will now be available starting Monday, October 13. Your Woodsville Guaranty Savings Bank debit card will no longer work on October 13, and you should begin using your Bar Harbor Bank & Trust debit card starting on October 13 for all transactions.

Bar Harbor Bank & Trust debit cards will now be available starting Monday, October 13. Your Woodsville Guaranty Savings Bank debit card will no longer work on October 13, and you should begin using your Bar Harbor Bank & Trust debit card starting on October 13 for all transactions.![]() If you need to change your online banking password, please do so before Friday, October 10. Any changes made after that date will not be carried over to Bar Harbor Online during conversion.

If you need to change your online banking password, please do so before Friday, October 10. Any changes made after that date will not be carried over to Bar Harbor Online during conversion.

Get rewarded for using your debit card. E-Choice and Relationship Rewards Checking customers earn cash back on daily purchases. More details can be found at

Get rewarded for using your debit card. E-Choice and Relationship Rewards Checking customers earn cash back on daily purchases. More details can be found at