Effective July 14, 2025, the Federal Reserve is requiring all United States financial institutions to use the ISO 20022 format to send domestic wires transfers. There are significant wire format and field label changes associated with this migration.

At Bar Harbor Bank & Trust, we are committed to providing you with the best possible service and the resources you need to help you be successful. Below, you will find important information about ISO 20022 and its impact on wire transfers.

What You Need to Know:

- The Federal Reserve is requiring all US banks implement ISO 20022 as the standard message format for sending wires beginning on July 14, 2025.

- ISO 20022 enables improved data sharing, faster processing, enhanced security, and more transparency across financial institutions.

- When ISO 20022 goes into effect, the words used to describe wire fields will change. A guide to the new terminology can be found here.

- The July 2025 update only impacts domestic wire transfers. International wires will not be impacted until November 2025.

- Beginning July 14, the cutoff time for domestic wires will be 3:00 pm on weekdays. Requests made after the cutoff time will be processed the following business day.

- The Federal Reserve and our software partners are continually releasing new information about the transition to ISO 20022. We will add any pertinent information we receive to this page to ensure you have access to the most current information.

What You Need to Do:

1. Familiarize yourself with ISO 20022 terminology and naming conventions.

Watch this video for an overview of what to expect:

Click here for a list of the terminology changes. Additional information is available at www.iso20022.org.

2. Mark your calendar for July 14, 2025.

- Beginning on July 14, all wires must be in the ISO 20022 format. Any wires in the old format, even if previously scheduled, will not be accepted by the Federal Reserve or transmitted.

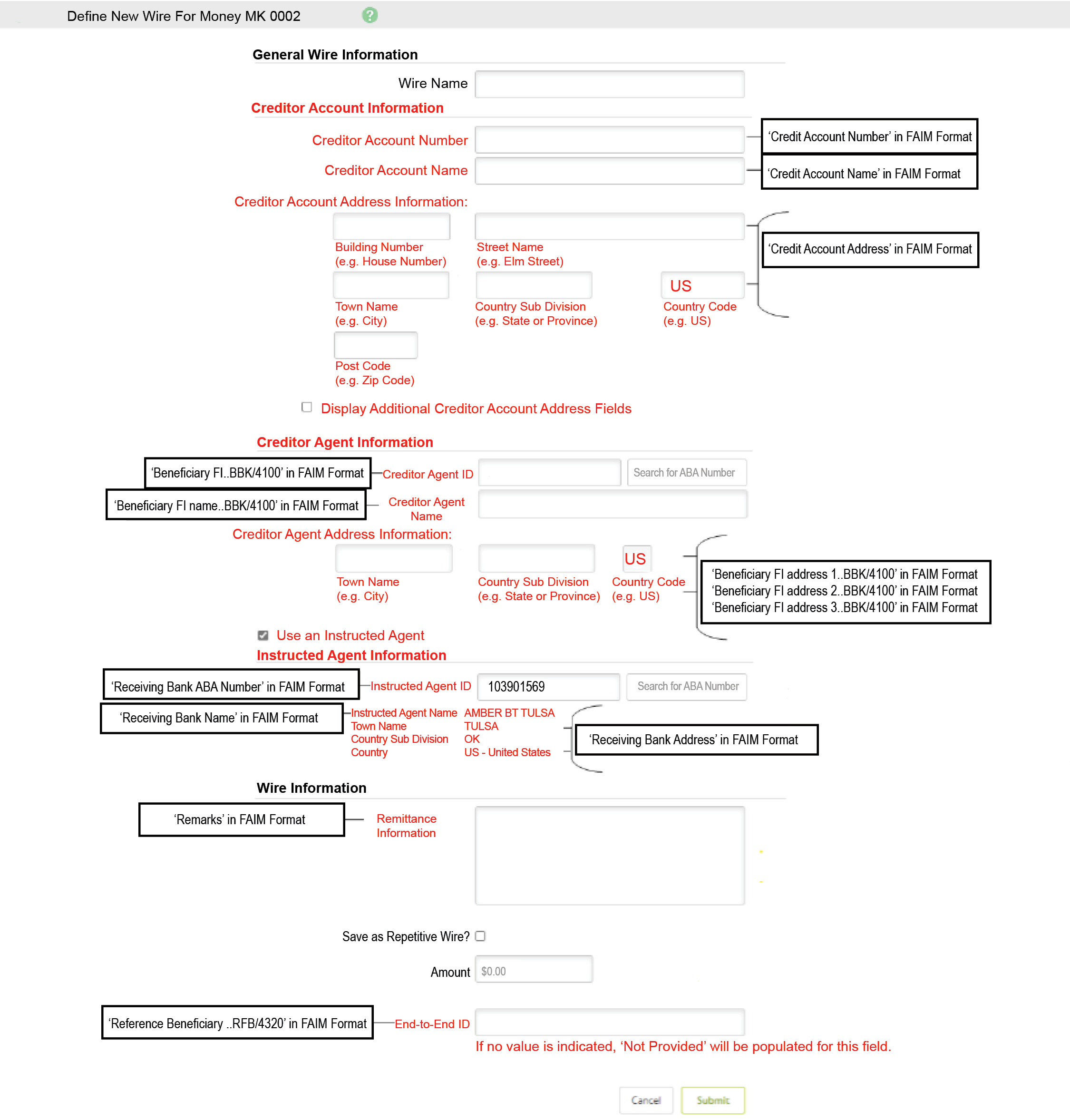

- On July 14 you will see changes to the naming conventions for the wire fields and their labels within Bar Harbor Cash Management. The process for entering wires will be the same but with the new terminology. Click here for a preview of the new fields and on-screen changes.

3. Update your wire templates on or after July 14, 2025.

- Existing wire templates will not be converted and will need to be recreated on or after July 14.

- On July 14, new wire screens will be available within Cash Management reflecting the new ISO 20022 terminology. Wire templates will need to be recreated using these new screens.

- Prior to July 14 you should save the information from your current wire templates so that you can easily recreate everything after the transition to ISO 20022.

- Prior to July 14 please print, screenshot, or copy and paste your current wire template information into a secure document that you can reference once the transition to ISO 20022 is complete. Unfortunately, there is no way to export existing wire templates from Bar Harbor Cash Management.

- Click here for a helpful guide for entering wire templates in the new format.

4. Review and update your Creditors (formerly called Beneficiaries) on or after July 14, 2025.

- Please plan to revise your Creditors on July 14 to make necessary updates, especially any that are tied to future-dated or recurring wires. You won’t be able to make changes to Creditor information prior to July 14, so it is important that you make changes immediately after the transition.

- Reach out to your Creditors to ensure you have their most up-to-date wire information.

- To simplify this process, review existing wires and delete any that are no longer needed prior to July 14.

5. Save a copy of your Wire History.

Our software partner has indicated that there is potential that Wire History prior to July 14 will not be available after the transition. We recommend that you save a copy of your wire history prior to July 14 for your records.

6. Prepare for the new wire cutoff time and potential delays surrounding the transition.

Beginning July 14, the cutoff time for domestic wires will be 3:00 pm on weekdays. Requests made after the cutoff time will be processed the following business day. We are doing everything we can to ensure a smooth transition to ISO 20022. However, to avoid potential delays we recommend that:

- If possible, avoid initiating any wires on July 14, 2025.

- If you need to send wires during the week of July 7, 2025, send them early in the week.

If you have questions about this transition or you are interested in exploring other payment options, please contact your Treasury Sales Officer directly or the Treasury Support team at treasurysupport@barharbor.bank or 207-669-6779.

ISO 20022 Terminology

The ISO 20022 standard will introduce new terminology that will be used universally. New terminology is outlined below.

Note: Additional address fields available for Creditor Account Address in ISO include: Post Box, Department, Sub Department, Building Name, Floor, Room, Town Location Name, and District Name.

Examples of On-Screen Changes

When ISO 20022 goes into effect the screen for creating a new wire within Bar Harbor Cash Management will reflect the terminology. A preview of the updated screen can be found below:

Additional Support

Questions? We’re here to help. For assistance, contact your Treasury Sales Officer directly or the Treasury Support team at treasurysupport@barharbor.bank or 207-669-6779.